Discover the power of candlestick patterns in improving your trading skills. These tools offer valuable insights into market dynamics, informing strategic choices for potential reversals, trend continuations, and entry/exit points. Our article is your expert guide to mastering candlestick patterns, revealing essential strategies for successful trades. Explore the world of trading with confidence and skill.

The Basics of Candlestick Patterns

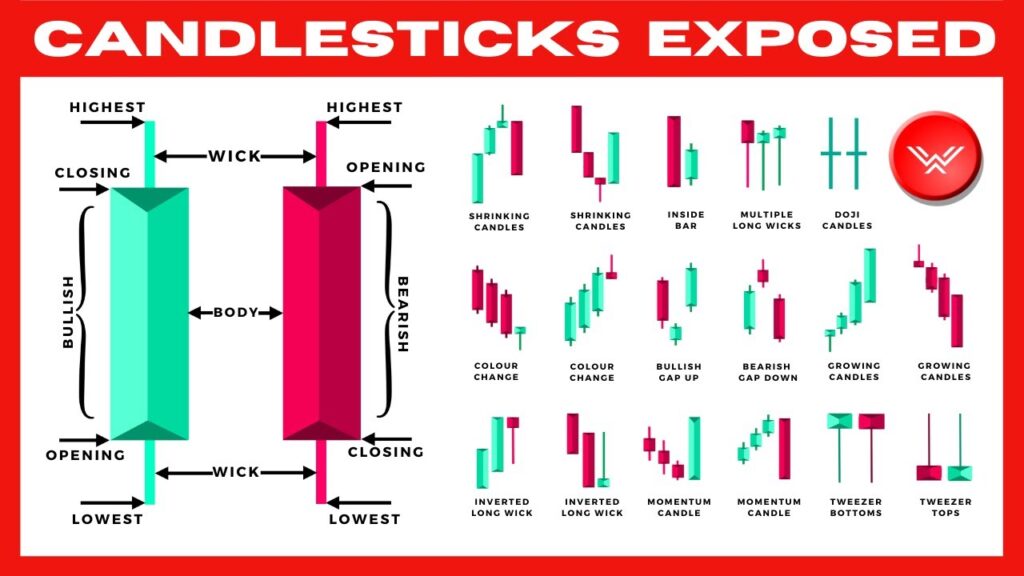

Candlestick charts display price movements in a visually appealing and informative manner. Each candlestick represents a specific time period and provides valuable information about the opening, closing, and high, and low prices within that period. Understanding the anatomy of a candlestick is essential to interpreting the patterns it forms.

Common Candlestick Patterns

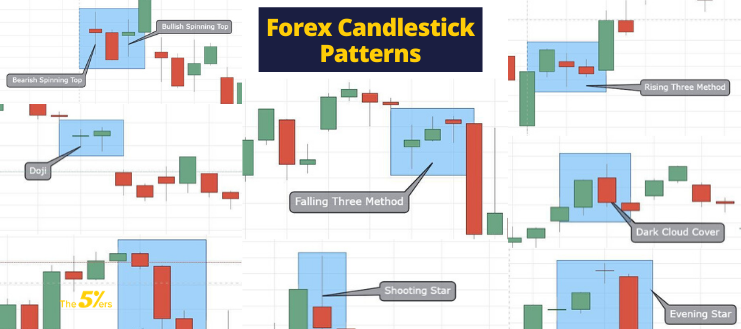

There are numerous candlestick patterns, each with its own unique characteristics and implications. Some widely recognized patterns include:

- Doji: A doji indicates indecision in the market, with the opening and closing prices nearly equal. It suggests potential trend reversals.

- Hammer: A hammer pattern appears at the bottom of a downtrend and signifies a possible bullish reversal.

- Engulfing: An engulfing pattern occurs when one candle fully engulfs the previous one. It suggests a potential reversal of the prevailing trend.

- Morning Star: The morning star pattern is a three-candle pattern that signifies a bullish reversal, often appearing after a downtrend.

- Shooting Star: A shooting star pattern appears at the top of an uptrend and suggests a potential bearish reversal.

Confirmation and Timing

While candlestick patterns offer valuable insights, confirmation from other technical indicators or chart patterns can strengthen their reliability. It’s essential to consider additional factors such as volume, trendlines, support and resistance levels, and oscillators to confirm the signals provided by candlestick patterns. Additionally, timing is crucial when executing trades based on these patterns. Utilize multiple timeframes to align your entries and exits with the overall market context.

Risk Management and Trade Execution

Successful trading involves effective risk management and disciplined trade execution. Set clear stop-loss and take-profit levels based on your risk tolerance and the patterns you identify. Implement proper position sizing techniques to manage your overall portfolio risk. Stick to your trading plan and avoid emotional decision-making, even when faced with conflicting signals.

Continual Learning and Practice

Mastering candlestick patterns is an ongoing process that requires continuous learning and practice. Familiarize yourself with various candlestick patterns, study historical price charts, and analyze real-time market data to enhance your pattern recognition skills. Backtest your strategies and keep a trading journal to track your progress and identify areas for improvement.

The Art of Successful Trading

Becoming proficient in candlestick patterns is akin to mastering a refined art form. It necessitates perseverance, devoted effort, and a persistent desire to advance. Over time, with practice, you can cultivate a keen ability to spot patterns, fortify your trading acumen, and enhance the probability of consistently profitable trades.